SEPA Instant – Terms & Conditions Update

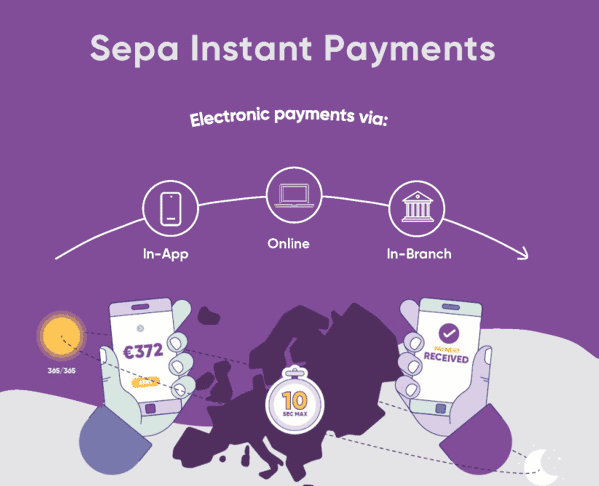

27 June, 2025We are updating our Framework Contract to reflect the upcoming launch of SEPA Instant, a new payment feature that allows you to send and receive euro payments in under 10 seconds, available 24/7 across participating European banks.

The new Credit Union framework contract can be viewed on our website (at the link below) or contact the office and a copy will be provided.

These updates will take effect from 1st September and include details on the use of SEPA Instant transfers, such as:

- There is no additional payment charge to use SEPA Instant.

- You cannot send SEPA Instant payments to or from some credit card accounts, mortgages, and certain deposit accounts. However, you can still send and receive money using the existing payment options for these accounts.

- We will notify you when an outgoing SEPA Instant Credit Transfer has been processed, indicating whether or not it was successful. If we do not receive confirmation within 10 seconds that the payment was received, we will restore your account to the state it would have been in had the transaction not taken place.

How to Accept the Changes

Your framework contract is valid up to 31st August 2025 and the new Framework Contract is effective from 1st September 2025.

You do not need to take any action to accept these changes. By continuing to use your account and our services after the changes take effect, you will be considered to have accepted them.

If you do not wish to accept the changes, you have the right to close your account or end your agreement with us free of charge, provided that any outstanding balances or fees have been cleared. You can do this by writing to our office or contacting us through our usual service channels.

We understand that some customers may not wish to accept the changes outlined in this guide. If this applies to you, please take action before 31st August 2025, after which the new terms will be applied automatically.

You can find more information about SEPA Payments below

EU Payment Services Regulation

« Three in a Row for Credit Unions as they top the Ireland Reputation Index 2025

𝐌𝐨𝐧𝐚𝐠𝐡𝐚𝐧 𝐂𝐫𝐞𝐝𝐢𝐭 𝐔𝐧𝐢𝐨𝐧 𝐑𝐞𝐧𝐞𝐰𝐬 𝐒𝐩𝐨𝐧𝐬𝐨𝐫𝐬𝐡𝐢𝐩 𝐨𝐟 𝐌𝐨𝐧𝐚𝐠𝐡𝐚𝐧 𝐋𝐆𝐅𝐀 𝐋𝐞𝐚𝐠𝐮𝐞𝐬 𝐟𝐨𝐫 𝐓𝐡𝐢𝐫𝐝 𝐂𝐨𝐧𝐬𝐞𝐜𝐮𝐭𝐢𝐯𝐞 𝐘𝐞𝐚r »